Getting auto insurance could be tricky. You might be pulling in coverage that you don’t really need and the bad news is you have to pay for this. All those extra insurance coverage that are made too important by the dealers may just be an additional expense to your budget. They could highlight the importance of each coverage but in the end, it is you who can determine which is applicable to your ability to pay and how sure you are that you can’t have those kind of damages. It is very important to know the different types of auto insurance coverage to determine what you need, what you want, and what you don’t want to include in your coverage.

There is a lot of auto insurance coverage that are available for various cars and you have the power to compare auto insurance quotes. This way, you are able to see the difference between companies and adjust your insurance deductibles according to your means. To help you reach a decision, it might be a good idea to get a quote from these companies.

A quote is a detailed list of amount and types of coverage you will be paying for. The amount and the coverage varies from company to company that is why would need to do your homework which is to compare auto insurance quotes before fully committing to a single auto insurance.

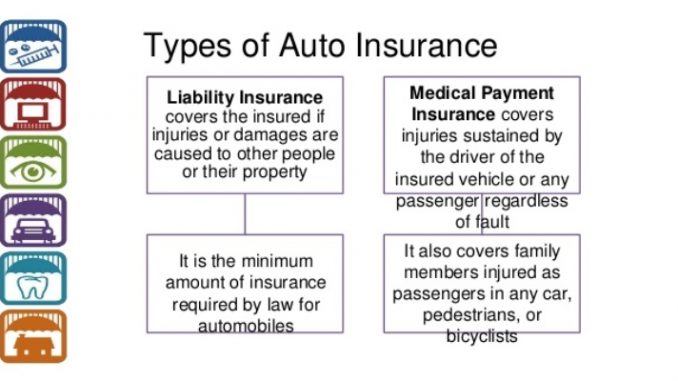

Some auto insurance coverage includes bodily injury liability that covers medical expenses for vehicular accidents. Not only is your car covered but also the persons harmed from the accident you have caused. We can never be too sure on the road. Accidents happen and it is better to be very prepared than to bleed your pockets. Another would be property liability which is a requirement for a lot of states. It pays for damages like cars and those stationary things. There is a need for you to study all the required insurance coverage for your state in order for you to abide by the rules and avoid any lawsuits. Remember that spending your money on things like this would help you save more in the future. To be more specific, you may just compare auto insurance quotes per state or simply enter your zip code and get all the latest details about what you need to do.

If you have a weak personal health insurance, you may still be covered by an Uninsured Motorist insurance which entitles you to be covered by your auto insurance in vehicular accidents.