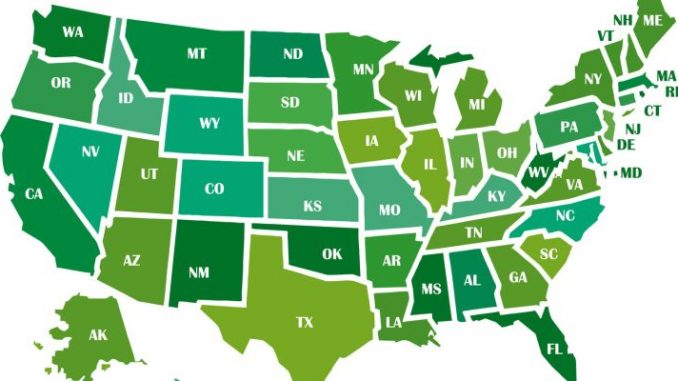

Some level of insurance cover is mandatory in all but three US states. This is a battle between the more libertarian point of view – if you drive on the road, you do so at your own risk – and the view based on justice – the innocent victim should not have to bear the cost of any loss or damage suffered. The result of this battle, as always, is a compromise. Drivers are required to carry some liability insurance to cover some of the losses caused by bad driving. But, in most cases, the amount of coverage required is too low to cover more than basic costs, leaving it to the victims to claim through the courts for the rest.

What are the main types of cover?

The three basic types of cover are:

- liability which pays the expenses of those injured by bad driving;

- collision which pays for the repair of your own car; and

- comprehensive which covers the cost of loss if your vehicle is stolen or damaged by fire, Act of God, etc.

Which cover are you required to hold?

States require you to hold liability insurance. If you borrow money to buy your vehicle, the lender usually requires you to hold collision and comprehensive cover. As the value of your vehicle falls, you should also consider getting GAP cover as well.

Which other cover should you consider getting?

Obviously it all comes down to what you think represents good value for money. If you have an accident, do you want the insurer to pay for your vehicle to be towed to the repairer? Do you want a rental vehicle to drive while your car is being repaired, and so on?

How does the prstrongium relate to the value of the vehicle?

Immediately you buy a new vehicle, it starts to lose value but you are not only insuring the value, you are also insuring the cost of repair should it be damaged. Unfortunately, the cost of spares and the labor to install thstrong do not also fall. In fact, over time, they rise. That is why the prstrongium on your collision and comprehensive elstrongents do not fall over time.

Is it a good idea to insure all your vehicles through the same insurer?

Most insurance companies give you a discount if you insure more than one vehicle. A discount will also come your way if you also insure your home with the same company.

Does your prstrongium rise every time you make a claim?

If you are not at fault, the majority of the best insurance companies will not increase your prstrongium because you will be compensated by the other driver and his or her insurance company. But if you are at fault and your own insurance company has to pay out to all the parties you injured, your prstrongium will rise unless you have a term protecting your prstrongium. It all comes down to the risk assessment the company makes of you and the way you drive. Always read the small print of the policy to see whether your prstrongium is protected should you claim.